Illinois needs Fair Tax Reform

Lift the burden from the middle class. Make the millionaires pay their share.

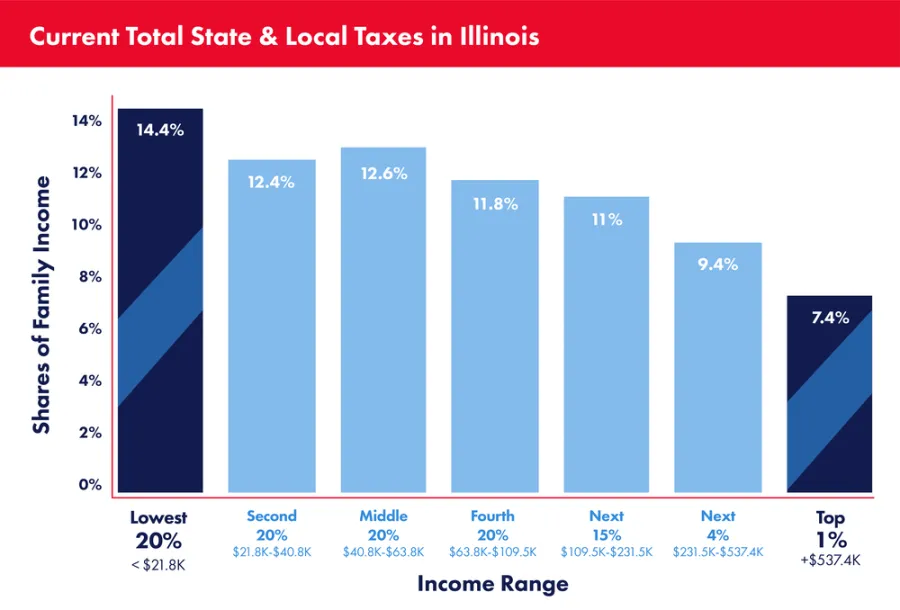

We need fair tax reform because the old way of taxing income in Illinois is unfair and inadequate. Working people need relief and Illinois needs revenue for critical public services like education, human services, health care, infrastructure, public safety and jobs.

If the Fair Tax ballot measure is approved by voters in November, the wealthiest top 3% of taxpayers will pay a little more on income over a quarter-million dollars a year, while the rest of us—97%—get a tax cut or pay no more than we do now.

Join the movement to rebuild our state!

Fair Tax News

- Working people need relief

- Tribune column debunks false attacks on Fair Tax

- Coronavirus raises stakes for Fair Tax: We need it more than ever

- Fair Tax passes General Assembly, moves to ballot

- Official ballot language for the Fair Tax

Interactive Map

This map shows the percentage of taxpayers in each county who will pay less (or the same) if fair tax reform is passed. Click here to download a Fair Tax handout, which includes this map.